Canada Emergency Rent Subsidy (CERS)

On November 19, 2020, Bill C-9 passed royal assent, and this legislation enacted Canada Emergency Rent Subsidy (CERS) and amendment to CEWS. Below we provide a summary of CERS.

Publish at: 2020-11-20

Canada Emergency Rent Subsidy (CERS)

On November 19, 2020, Bill C-9 passed royal assent, and this legislation enacted Canada Emergency Rent Subsidy (CERS) and an amendment to CEWS. Below we provide a summary of CERS.

Eligibility:

You would be eligible for CERS if you are individuals, taxable corporations, trusts, NPO or registered charities.

How much you can get:

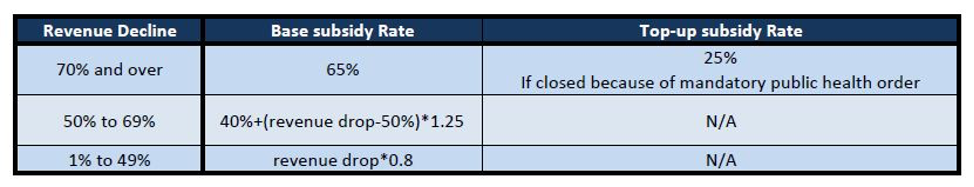

The subsidy is calculated as follow: (Base subsidy rate + Top-up subsidy rate)* Eligible expenses

Revenue will be calculated in the same manner as CEWS

Eligible expenses

are:Commercial rent before GST/HST

Property taxes (including school and municipal taxes)

Property insurance

Interest on commercial mortgage

Eligible expenses are capped at $75,000 per location in each period and $300,000 among affiliated entities per period.

Non-eligible expenses are:

New expenses for which the written agreement entered into after Oct 9, 2020

Expenses for foreign properties

Residential property expenses used by the taxpayer (e.g., house or cottage)

Payments between non-arm’s-length entities

Periods you can apply for:

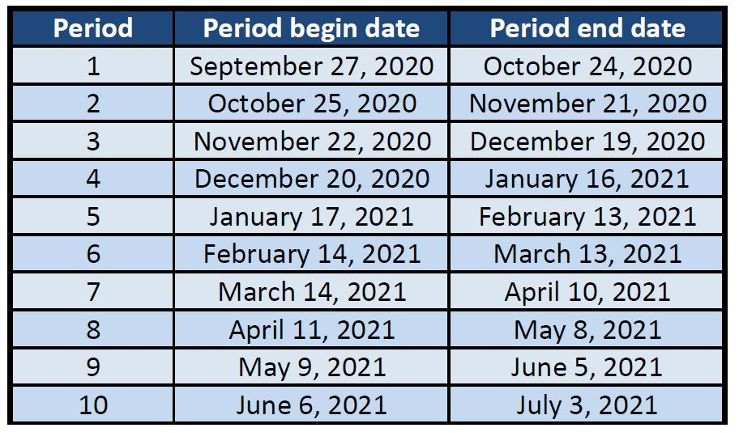

CERS would be available to apply from Oct 2020 to June 2021. Businesses need to apply for the rent subsidy after the month has passed. The deadline to apply for each period is 180 days after the end of that period.

Prime Minister Justine Treadue mentioned that eligible entities would be able to apply for CERS starting November 23, 2020, in the public speech today.

Prime Minister Justine Treadue mentioned that eligible entities would be able to apply for CERS starting November 23, 2020, in the public speech today.

How to apply:

Online through CRA My Business Account.

Reference:

Department of Finance Canada

https://www.canada.ca/en/department-finance/news/2020/11/canada-emergency-rent-subsidy.html