2021 Federal Budget Highlights - Business Measures

2021 Federal Budget Highlights - Business Measures

Publish at: 2021-05-06

On April 19, 2021, the Deputy Prime Minister and Finance Minister, the Honourable Chrystia Freeland, presented Budget 2021: A Recovery Plan for Jobs, Growth, and Resilience, to the House of Commons. Here are some highlights:

Canada Emergency Wage Subsidy (CEWS)

Extension and Phase-out for Active Employees.

Budget 2021 proposes that CEWS will be extended to September 25, 2021, but will start phasing out after July 3, 2021. Only employers with more than a 10% decline in revenues will be eligible for the wage subsidy as of that date.

Requirement to Repay Wage Subsidy – Public Corporations

Budget 2021 proposes to require a publicly listed corporation to repay wage subsidy amounts received for a qualifying period that begins after June 5, 2021 in the event that its aggregate compensation for specified executives during the 2021 calendar year exceeds that of the 2019 calendar year.

Specified executives are the Named Executive Officers whose compensation is required to be disclosed under Canadian securities laws in the annual information circular provided to shareholders, or similar executives in the case of a corporation listed in another jurisdiction.

The amount of the wage subsidy required to be repaid would be equal to the lesser of:

the total of all wage subsidy amounts received in respect of active employees for qualifying periods that begin after June 5, 2021; and

the amount by which the corporation’s aggregate specified executives’ compensation for 2021 exceeds that of 2019.

This applies to wage subsidy amounts paid to any entity in the group.

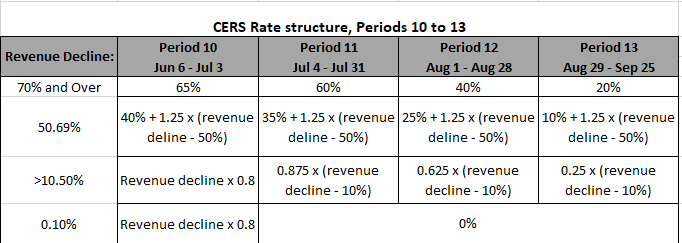

Canada Emergency Rent Subsidy (CERS)

Extension and Phase-out

Budget 2021 proposes that CERS will be extended to September 25, 2021, but will start phasing out after July 3, 2021. Paralleling CEWS, only employers with more than a 10% decline in revenues will be eligible for CERS as of that.

Lockdown Support

Budget 2021 proposes to extend lockdown support to September 25, 2021 at a 25% rate (unchanged).

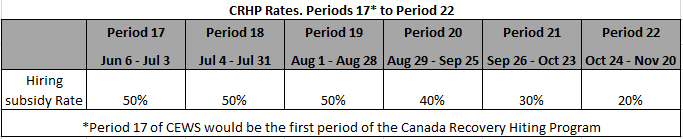

Canada Recovery Hiring Program (CRHP)

Budget 2021 proposes the new CRHP to provide eligible employers with a subsidy of up to 50% of the incremental remuneration paid to eligible employees between June 6, 2021 and November 20, 2021.

The higher of CEWS or CRHP could be claimed for a particular qualifying period, but not both.

Eligible Employers

Employers eligible for CEWS would generally be eligible for CRHP. However, a for-profit corporation would be eligible for the hiring subsidy only if it is a Canadian-controlled private corporation (CCPC). Eligible employers (or their payroll service provider) must have had a CRA payroll account open March 15, 2020.

Eligible Employees

An eligible employee must be employed primarily in Canada by an eligible employer throughout a qualifying period (or the portion of the qualifying period throughout which the individual was employed by the eligible employer). CRHP will not be available for furloughed employees. A furloughed employee is an employee who is on leave with pay, meaning they are remunerated by the eligible employer but do not perform any work for the employer. However, an individual would not be considered to be on leave with pay for the purposes of the hiring subsidy if they are on a period of paid absence, such as vacation leave, sick leave, or a sabbatical.

Eligible Remuneration and Incremental Remuneration

The same types of remuneration eligible for CEWS would also be eligible for CRHP (e.g., salary, wages, and other remuneration for which employers are required to withhold or deduct amounts). The amount of remuneration for employees would be based solely on remuneration paid in respect of the qualifying period.

Incremental remuneration for a qualifying period means the difference between:

an employer’s total eligible remuneration paid to eligible employees for the qualifying period, and

its total eligible remuneration paid to eligible employees for the base period.

Eligible remuneration for each eligible employee would be subject to a maximum of $1,129 per week, for both the qualifying period and the base period. Similar to CEWS, the eligible remuneration for a non-arm’s length employee for a week could not exceed their baseline remuneration determined for that week. The base period for all application periods is March 14 to April 10, 2021.

Required Revenue Decline

To qualify, the eligible employer would have to have experienced a decline in revenues. For the qualifying periods between June 6, 2021 and July 3, 2021, the decline would have to be greater than 0%. For later periods, the decline must be greater than 10%.

Similar to CEWS and CERS, an application for a qualifying period would be required to be made no later than 180 days after the end of the qualifying period.

Federal Minimum Wage

Establishing a federal minimum wage of $15 per hour, rising with inflation, for those workers in the federally regulated private sector.

Immediate Expensing

Budget 2021 proposes to permit the full cost of “eligible property” acquired by a CCPC on or after Budget Day to be deducted, provided the property becomes available for use before January 1, 2024. Up to $1.5 million per taxation year is available for sharing among each associated group of CCPCs, with the limit being prorated for shorter taxation years. No carry forward of excess capacity would be allowed.

Eligible Property

Eligible property includes capital property that is subject to the CCA rules, other than property included in CCA classes 1 to 6, 14.1, 17, 47, 49 and 51. The excluded classes are generally those that have long lives, such as buildings, fences, and goodwill.

Interactions of the Immediate Expensing with Other Provisions

Where capital costs of eligible property exceed $1.5 million in a year, the taxpayer would be allowed to decide which assets would be deducted in full, with the remainder subject to the normal CCA rules.

Other enhanced deductions already available, such as the full expensing for manufacturing and processing machinery, would not reduce the maximum amount available ($1.5 million).

Restrictions

Generally, property acquired from a non-arm’s length person, or which was transferred to the taxpayer on a tax-deferred “rollover” basis, would not be eligible.

Also, there are several other rules that limit CCA claims that would continue to apply, such as limits to claims on rental losses.

Rate Reduction for Zero-Emission Technology Manufacturers

Budget 2021 proposes a temporary measure to reduce corporate income tax rates for qualifying zero-emission technology manufacturers, halving the tax rate on eligible zero emission technology manufacturing and processing income to 7.5% on income subject to the general corporate tax rate (normally 15%), and 4.5% where that income would otherwise be eligible for the small business deduction (normally 9%). Provincial taxes would still apply to this income.

For taxpayers with income subject to both the general and the small business corporate tax rates, taxpayers would be able to choose the income on which the rate would be halved.

Manufacturing of components or sub-assemblies will be eligible only if such equipment is purpose-built or designed exclusively to form an integral part of the relevant system. Eligible income would be determined as a proportion of “adjusted business income” determined by reference to the corporation’s total labour and capital costs that are used in eligible activities.

The reduced tax rates would require the corporation to derive at least 10% of its gross revenue from all active businesses carried on in Canada from eligible activities. The reduced tax rates would apply to taxation years that begin after 2021. The reduced rates would be gradually phased out starting in taxation years that begin in 2029 and fully phased out for taxation years that begin after 2031.

Capital Cost Allowance (CCA) for Clean Energy Equipment

Under the CCA regime, Classes 43.1 and 43.2 provide accelerated CCA rates (30% and 50%, respectively) for investments in specified clean energy generation and energy conservation equipment. Budget 2021 proposes to expand Classes 43.1 and 43.2 to include a variety of assets used to generate energy from water, solar or geothermal sources or waste material, or related to hydrogen production or utilization. Accelerated CCA would be available in respect of these types of property only if, at the time the property becomes available for use, the requirements of all Canadian environmental laws, by-laws and regulations applicable in respect of the property have been met.

Film or Video Production Tax Credits

Budget 2021 proposes to temporarily extend certain timelines for the Canadian Film or Video Production Tax Credit and the Film or Video Production Services Tax Credit by 12 months (in addition to certain extensions previously announced). These measures would be available in respect of productions for which eligible expenditures were incurred by taxpayers in their taxation years ending in 2020 or 2021.

Audit Authorities

CRA possesses the authority to audit taxpayers. Budget 2021 proposes amendments to confirm that CRA officials have the authority to require persons to answer all proper questions, and to provide all reasonable assistance, and to require persons to respond to questions orally or in writing, including in any form specified by the relevant CRA official. These measures would come into force on Royal Assent.

Support for Businesses to Adopt New Digital Technologies

Investing $1.4 billion over four years to assist small and medium business to access grants and technical support associated with adopting new technologies.

Regional Relief and Recovery Fund

Extending the application deadline for similar support to the Canada Emergency Business Account (CEBA) offered under the Regional Relief and Recovery Fund and the Indigenous Business Initiative until June 30, 2021. The CEBA application deadline was previously extended to June 30, 2021.

Digital Services Tax (DST)

Budget 2021 proposes to implement a DST. The tax is “intended to ensure that revenue earned by large businesses – foreign or domestic – from engagement with online users in Canada, including through the collection, processing and monetizing of data and content contributions from those users, is subject to Canadian tax”. The DST would apply as of January 1, 2022. A 3% tax is proposed to be imposed on revenues generated from online marketplaces, social media, online advertising, and the sale or licensing of user data. The tax would only apply to businesses with global revenue of $750 million, and Canadian revenue of more than $20 million.

Enhancing Anti-Avoidance Provisions

Budget 2021 proposes measures implementing recommendations of the OECD’s “Base Erosion and Profit Shifting” project focusing on:

restrictions on the deductibility of interest paid to non-arm’s length foreign entities to a fixed ratio of “tax EBIDTA” (earnings before interest, depreciation, tax and amortization), with exceptions for some CCPCs, and groups of Canadian entities whose aggregate net interest expense does not exceed $250,000; and

hybrid mismatch arrangements which take advantage of differences in the income tax treatment in different countries, such as situations where the same expense can be deducted in multiple countries, or a deduction is available in one country which is not taxable, within a reasonable period of time, in the other.

Input Tax Credit (ITC) Information Requirements ITC

Business can claim ITCs to recover the GST/HST that they pay for goods and services used as inputs in their commercial activities. Businesses must obtain and retain certain information in order to support their ITC claims, such as invoices or receipts.

The information requirements for these documents are graduated, with progressively more information required when the amount paid or payable in respect of a supply equals or exceeds thresholds of $30 or $150. Budget 2021 proposes to increase these thresholds to

$100 (from $30) and $500 (from $150).

In addition, under the ITC information rules, either the supplier or an intermediary (i.e., a person that causes or facilitates the making of a supply on behalf of the supplier) must

provide its business name and, depending on the amount paid or payable in respect of the supply, its GST/HST registration number, on the supporting documents. However, for the purposes of these rules, an intermediary currently does not include a billing agent (i.e., an agent that collects consideration and tax on behalf of an underlying vendor but does not otherwise cause or facilitate a supply). Instead, the recipient of the supply must obtain the

business name and registration number of the underlying vendor. Budget 2021 proposes to allow billing agents to be treated as intermediaries for purposes of the ITC information rules, removing this complexity.

Application of GST/HST to E-commerce

In the Fall Economic Statement 2020, the government proposed a number of changes to the GST/HST system relating to the digital economy, applicable to non-resident vendors supplying digital products or services, shipping goods from Canadian fulfillment warehouses, or facilitating short-term rental accommodation in Canada.

Under the proposals, GST/HST would be required to be collected and remitted by these entities commencing on July 1, 2021. Simplified registration and remittance frameworks would be available to these entities. Budget 2021 proposes amendments to these proposals to take stakeholder feedback into account, including safe harbour rules to protect platform operators who reasonably relied on the information provided by a third-party supplier, and clarifying several aspects of the legislation.

This is article is written only for general information and broad guidance. Please contact our office to discuss about your specific circumstances. We are not responsible for any damage resulting from your reliance on the information in this article.